ZA Bank

Description of ZA Bank

ZA Bank is a digital banking application designed for customers in Hong Kong. It serves as a platform for various banking services, including deposits, loans, foreign currency exchange, and more, all accessible from a mobile device. The app allows users to manage their finances efficiently and is available for the Android platform, making it convenient for users to download and utilize its features.

The application offers a range of functionalities tailored to meet the needs of its customers. Users can open a ZA Bank account quickly, with the process taking as little as two minutes in many cases. This streamlined account setup is particularly beneficial for those who may be on holiday or have limited time to engage in traditional banking procedures. Once registered, users gain access to comprehensive digital banking services available 24/7.

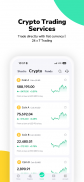

ZA Bank includes features that cater to the growing interest in cryptocurrency. It is recognized as Asia’s first licensed bank offering Crypto Trading Services for retail investors. Through the app, users can trade cryptocurrencies directly using Hong Kong dollars (HKD) or United States dollars (USD) from their savings deposits. This feature supports continuous trading, allowing users to engage with the crypto market at any time of day.

The app also provides a Visa debit card known as the ZA Card, which is notable for its customizability. Users can personalize their card number, enhancing their banking experience. The physical card is designed with security in mind, as it does not include a CVV or expiration date, reducing the risk of theft. This focus on security extends throughout the app, ensuring that users can manage their finances with confidence.

For those looking to conduct transactions, ZA Bank facilitates local transfers and overseas remittances. The app simplifies the process of sending money to other accounts, making it an effective tool for users who need to handle financial matters both locally and internationally. The foreign currency exchange feature allows users to engage in transactions involving multiple currencies, further enhancing the app's functionality.

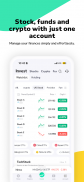

Investment options are also integrated into the app. Users can explore various investment opportunities, including stocks and funds, directly from their mobile devices. This integration allows users to manage their investment portfolios alongside their everyday banking activities, creating a comprehensive financial management tool.

Insurance products are another key offering in the ZA Bank application. Customers can review and purchase different insurance plans that meet their needs, all within the same platform. This feature simplifies the process of securing insurance, as users can compare options and make informed decisions without needing to visit multiple providers.

The app's user interface is designed to be intuitive, making navigation straightforward for users regardless of their technical proficiency. This focus on user experience helps ensure that all customers can take full advantage of the features available. The design is clean and functional, allowing users to focus on their banking activities without unnecessary distractions.

ZA Bank emphasizes compliance with local laws and regulations, ensuring that users are aware of their responsibilities when using the app. The application is intended solely for existing customers or individuals with valid identity documents and residential addresses. This focus on regulatory compliance contributes to the overall safety and reliability of the banking experience.

In addition to these features, ZA Bank recognizes the importance of customer support. Users can access assistance through various channels, ensuring that help is available whenever needed. This commitment to customer service enhances the overall user experience, providing peace of mind for those managing their finances through the app.

The extensive range of services offered by ZA Bank positions it as a comprehensive digital banking solution for its users. From opening an account to trading cryptocurrencies and managing investments, the app provides the tools necessary for effective financial management. Its emphasis on security, user experience, and regulatory compliance further enhances its appeal to customers.

Users interested in taking advantage of these features can easily download the ZA Bank app and begin their banking journey. The combination of convenience, security, and a wide array of services makes ZA Bank a notable choice for those seeking a digital banking solution in Hong Kong.

For more information about the services and features offered by ZA Bank, visit bank.za.group.